Steps for the Personal Representative

It can be overwhelming when a loved one passes away. The following steps are written as a guide for the next of kin or personal

2323 Lee Road, Winter Park, FL 32789

M-F 8:30-5:00

It can be overwhelming when a loved one passes away. The following steps are written as a guide for the next of kin or personal

When I use the word “trust” in a consultation, people often quickly tell me that they don’t have enough money or assets to require a

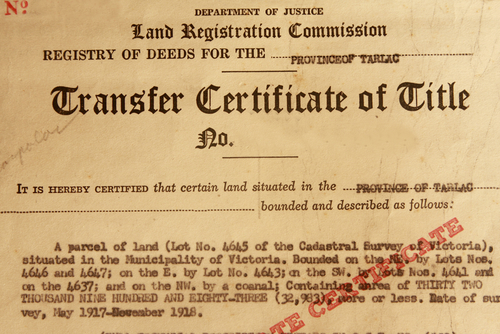

If you own out of state property, it’s almost a certainty that you and your family will be better served by a trust instead of

Recent surveys from Caring.com show that only 42% of U.S. adults have estate planning documents. The following cases could have been easily avoided with those

From where I sit, it’s not uncommon to find myself with a front row seat peering into the darker side of humanity. It’s hard to

During the month of January we began seeing a flurry of clients walk through the door with probate issues. Based on what we’re seeing, most

Developing an estate plan is perhaps one of the noblest actions you will take to ensure the efficient transfer of your assets to future generations

For many families, owning land is a rewarding way to build wealth while creating a tangible legacy for future generations. But along with claiming a

“Will my estate need to go through probate?” This is a question that we often hear in our office. Many people have had a bad

Florida homestead is a wonderful thing. When you invest in your home, you’re investing in what is most likely the largest purchase of your life.