Test-driving FindaRideFlorida.com

A new website from the Florida Department of Transportation’s Safe Mobility for Life Program, www.FindaRideFlorida.com, is designed to offer solutions to aging adults (and others)

2323 Lee Road, Winter Park, FL 32789

M-F 8:30-5:00

A new website from the Florida Department of Transportation’s Safe Mobility for Life Program, www.FindaRideFlorida.com, is designed to offer solutions to aging adults (and others)

If you own out of state property, it’s almost a certainty that you and your family will be better served by a trust instead of

Recent surveys from Caring.com show that only 42% of U.S. adults have estate planning documents. The following cases could have been easily avoided with those

National Old Stuff Day In honor of National Old Stuff Day on March 2nd, Your Caring Law Firm suggests you celebrate your old stuff by

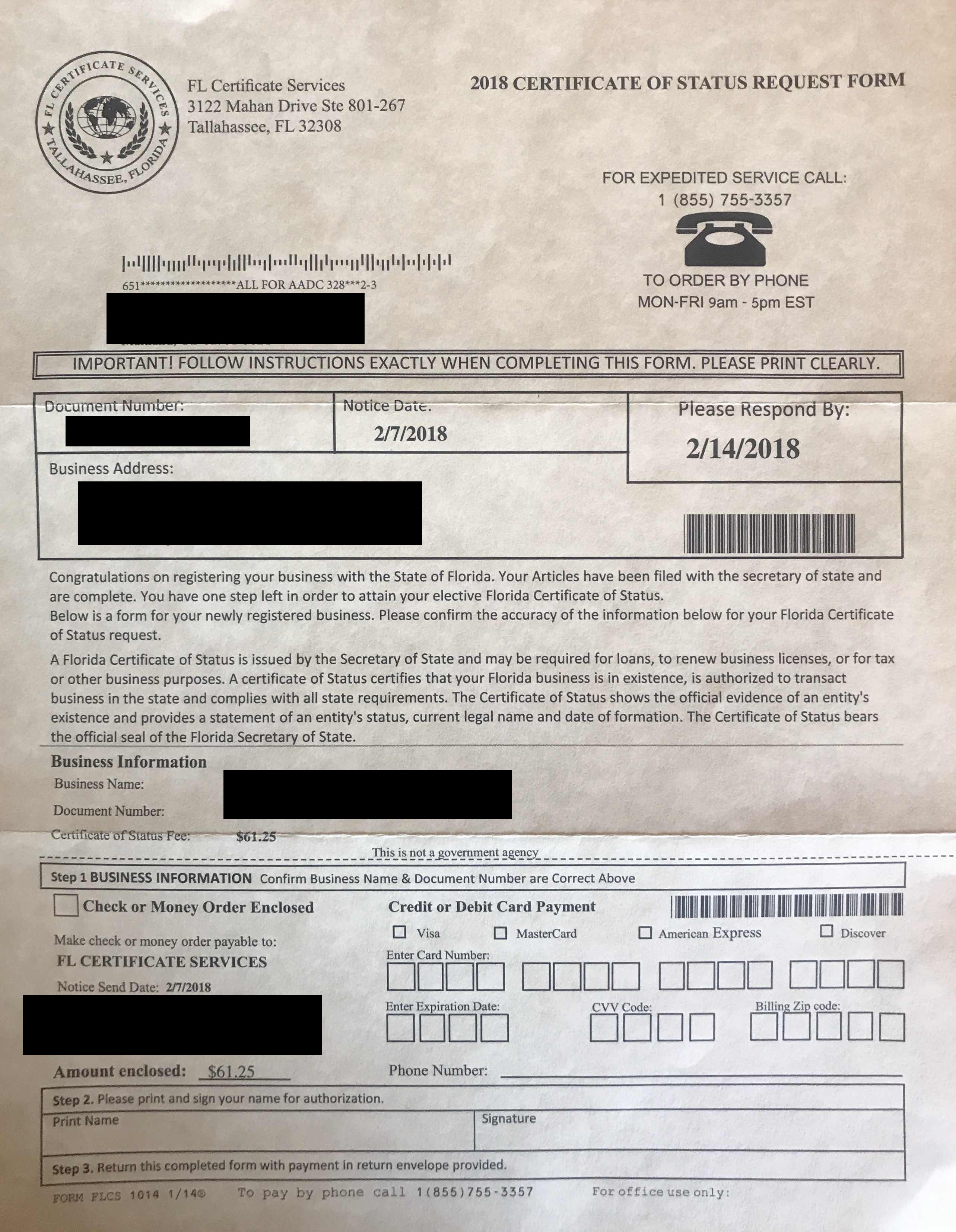

Every month, you probably receive dozens of solicitations. Some of them can look very official and urgent. For example, one of our clients received this

Perhaps it was a total coincidence that our services were terminated a day after our client met with his financial advisor; it is difficult for

The answer is an unequivocal, “maybe.” It is completely fact-based, depending on the circumstances of that particular RV or boat. The relevant terms in the

Houston under water. Puerto Rico destroyed. Central Florida battered. Natural disasters such as Hurricane Irma can be a sobering experience. Many clients and friends walked

It’s wonderful to live in the 21st century, where Amazon orders often arrive less than 24 hours after being placed, even on Sundays. Movies are

Mother’s Day is approaching. How are you planning to celebrate Mom this year? Flowers always are a safe bet. Perhaps you and your siblings could